Trading Journal #2

Trading Journal

Day started small red with SP500 and Nasdaq down 0.20% to clear overbought conditions. Overbought can remain overbought but tomorrow we are going to have FED minutes so it’s wise to manage risk carefully.

Morning Focus: AMD and AMZN range is getting tight so can trigger the next move. META printed a reversal buy so looking for possible continuation depending on market conditions. Keeping AAPL IWM TSLA SPY and QQQ on watch as those have been strong leaders and looking for clues if they keep momentum going or fade. Also looking how the market will react to WMT earnings and if it gives clues.

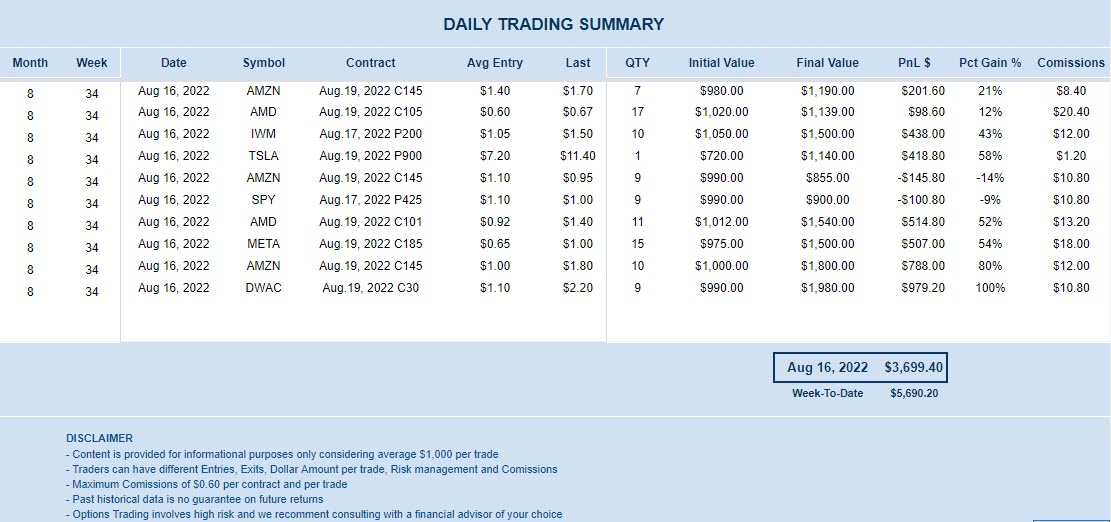

Our Trades: I started the day going after those AMD and AMZN Calls looking for the breakout but action stalled and price got rejected at highs so I took my gains and started looking for the “other side” as the market was fading. I took IWM short as I was seeing bear flow and I also saw TSLA rejected above 940s and pushed back below, so I took a scalp short for the fade. On the way down I took gains on both IWM and TSLA shorts and closed all. I started seeing some possible bottoming process as I saw yesterday so I got back into my morning plan: AMD AMZN META Calls so I took a position with a long scalp on all 3. Around lunch time I locked my gains as part of my risk management. Just before I went, I saw some bull flow on DWAC and I pulled the trigger on C30 that basically doubled in 4 min so I took the gains and ran!

Losses review: I got stopped on my first AMZN entry but that’s ok as part of trading. I waited some minutes to re-enter and got my money back and more.

Key Takeaways: Continuous improvement on being flexible and not “perma” anything. If trade does not work, close, take the “other side”, ride the “wave” and when done, get back to the initial plan and ride the wave on primary trend.

Look Ahead: So far the market keeps overbought, but it can remain overbought for longer. We are currently on long gamma, so basically buying dips and shorting rips has been the strategy. Keep riding the momentum while it lasts but manage risk wisely.

DISCLAIMER

This trading journal is a log of all the options trades made. It is a tool that I use to track my progress and improve my trading strategies over time. I use this information to analyze my trading performance, identify patterns, and improve my decision-making processes. By keeping a trading journal, I can learn from my successes and mistakes, and make better trading decisions in the future. You can use other tools for journal as TraderSync , Tradervue or Excel

Content is provided for informational purposes only considering average $1,000 per trade. Comissions already included: $0.60 per contract, per trade. All entries and exits are timestamped realtime via Discord Bot. Traders can have different Entries, Exits, Dollar Amount, Risk management and Comissions.

You can find all my journals on Blog. Past historical data is no guarantee on future returns