Trading Journal #9

Trading Journal

08:44 am: Futures green to start the day giving a nice follow through to our plan on bounce from Monday lows. Traders should look to trim some profits and raise stops on rest as Jackson Hole starts and the market waits for Mr.Powell speech.

08:45 am: Morning focus on NVDA after the earnings report to see if it bounces up to fill the morning gap or fades lower which can push AMD other Semis with it. TSLA is on watch for reaction after 3-1 stock split. Eyes on both tech stocks and yields that are both green this morning, so let’s see which fades first to trigger the next move.

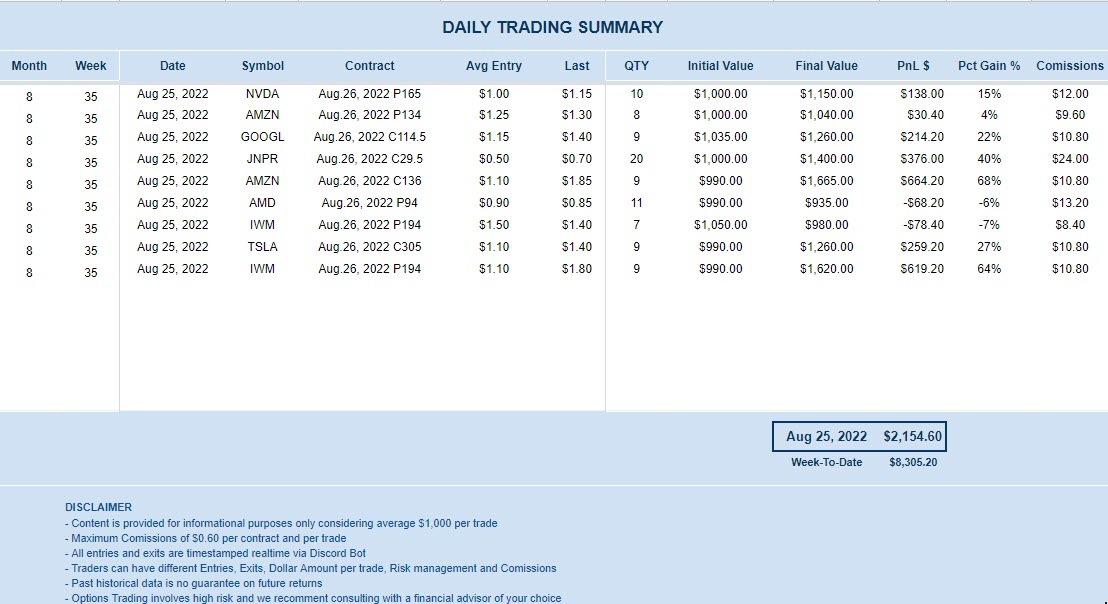

Morning Trades: I started the day with my left foot by shorting NVDA which was a big challenge but was able to save it (uffff… that’s what happens when we get squeezed…geeesh). I also tried to fade AMZN with some PUTs but that didn’t work, so I sold it and took the other side loading up on AMZN and GOOGL Calls for nice gains. I also saw bull flow on JNPR so I pressed the trigger and got a nice cash flow. After 10am I started testing the waters with some IWM Puts as the market was a bit overbought… started small but had to close it. Around 10:45am, I was able to load up big on IWM PUT and took it for about a 30min ride down for nice cash flow. Locked my gains and done for the day as the market got choppy and slow.

Losses review: I was having a big loss on NVDA but I kept my head straight and was able to save it and get out. I got small “paper cuts” testing the waters on IWM fade with small Puts, got stopped but was small size, so overall a nice risk management by keeping losses small.

Key Takeaways: Traders need to be flexible and don’t be stubborn… who cares if we are right or wrong!! If you are wrong, the sooner you take the loss the better! With small losses, you can quickly get into another trade and get your money back. If you are stubborn and hold the bag for too long, instead of a 10-15% loss you can go for 80-100% loss, so that’s tough!! Keep losses small!

Look Ahead: Market had the oversold bounce that I referred to on Monday and Tuesday, so that was good. Now, the next move is on Mr. Powell hands and no one really knows how the market will react to those words. As so, my risk management says cut your risk, raise cash and wait for price confirmation on the next leg up or down. Staying flexible and with an open mind for now.

DISCLAIMER

This trading journal is a log of all the options trades made. It is a tool that I use to track my progress and improve my trading strategies over time. I use this information to analyze my trading performance, identify patterns, and improve my decision-making processes. By keeping a trading journal, I can learn from my successes and mistakes, and make better trading decisions in the future. You can use other tools for journal as TraderSync , Tradervue or Excel

Content is provided for informational purposes only considering average $1,000 per trade. Comissions already included: $0.60 per contract, per trade. All entries and exits are timestamped realtime via Discord Bot. Traders can have different Entries, Exits, Dollar Amount, Risk management and Comissions.

You can find all my journals on Blog. Past historical data is no guarantee on future returns